Let’s talk about what happened in the market today and what to expect on Wednesday.

First, starting with today’s expiry of FINNIFTY, when I looked at Finnifty’s options data, it seemed like it would stay in the range of 21000 to 21050 for today’s expiry, and that’s exactly what happened. Surprisingly, Finnifty reached a high of 21161, though many expected it to go beyond 21200. The chart formation today is quite interesting, worth noting for future reference as judging the center today was very important.

FINNIFTY (chart taken from in.investing.com)

Now, onto Nifty bank stealing the spotlight today. It not only brought relief to our clients holding onto some banking stocks for the long term but also gave a boost to the entire Nifty rally. Bank Nifty hit a record high of 47230, closing above 47000 with a gain of around 580 points.

BANKNIFTY (chart taken from in.investing.com)

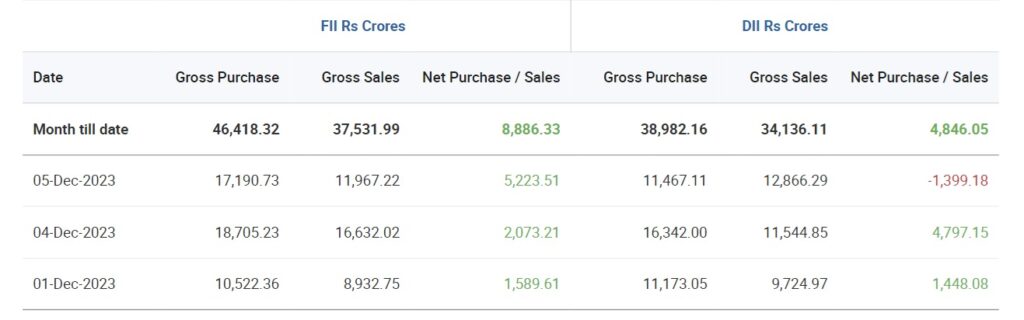

Who’s fueling this rally? It’s all thanks to smart investors who picked up stocks at low prices, averaging at key levels. Special mention to SIP and SWP schemes of mutual funds, giving DIIs the confidence to sell at higher prices. Today’s trading activities show DIIs were net sellers, offloading around 1399 crore, while the FIIs took the rally to the next level with net buying hitting the highest at approximately 5223 crore.

FII/DII data (chart taken from in.investing.com)

Now, looking ahead, what’s our view for the upcoming days? Join us for a live analysis to find out more.